When you make a substantial investment, you should do everything in your power to protect it from unforeseen risks. Kent & Essex Mutual Insurance has helped Ontarians do just that for over a century. If you’re a homeowner, business owner, car owner, or farmer, we will craft the perfect policy based on your unique needs. We also offer a range of combined policies (like home and auto or farm and business bundles), allowing you to secure all of your insurance needs in one place.

Browse Our Insurance ProductsYour Guide to Mutual Insurance

If this is your first time looking into an insurance policy, you’ve come to the right place. Consider this your Mutual Insurance Crash Course. In just three easy steps, we’ll show you exactly how you can become insured, protected, and a part of the Kent & Essex community.

Why Kent & Essex Mutual?

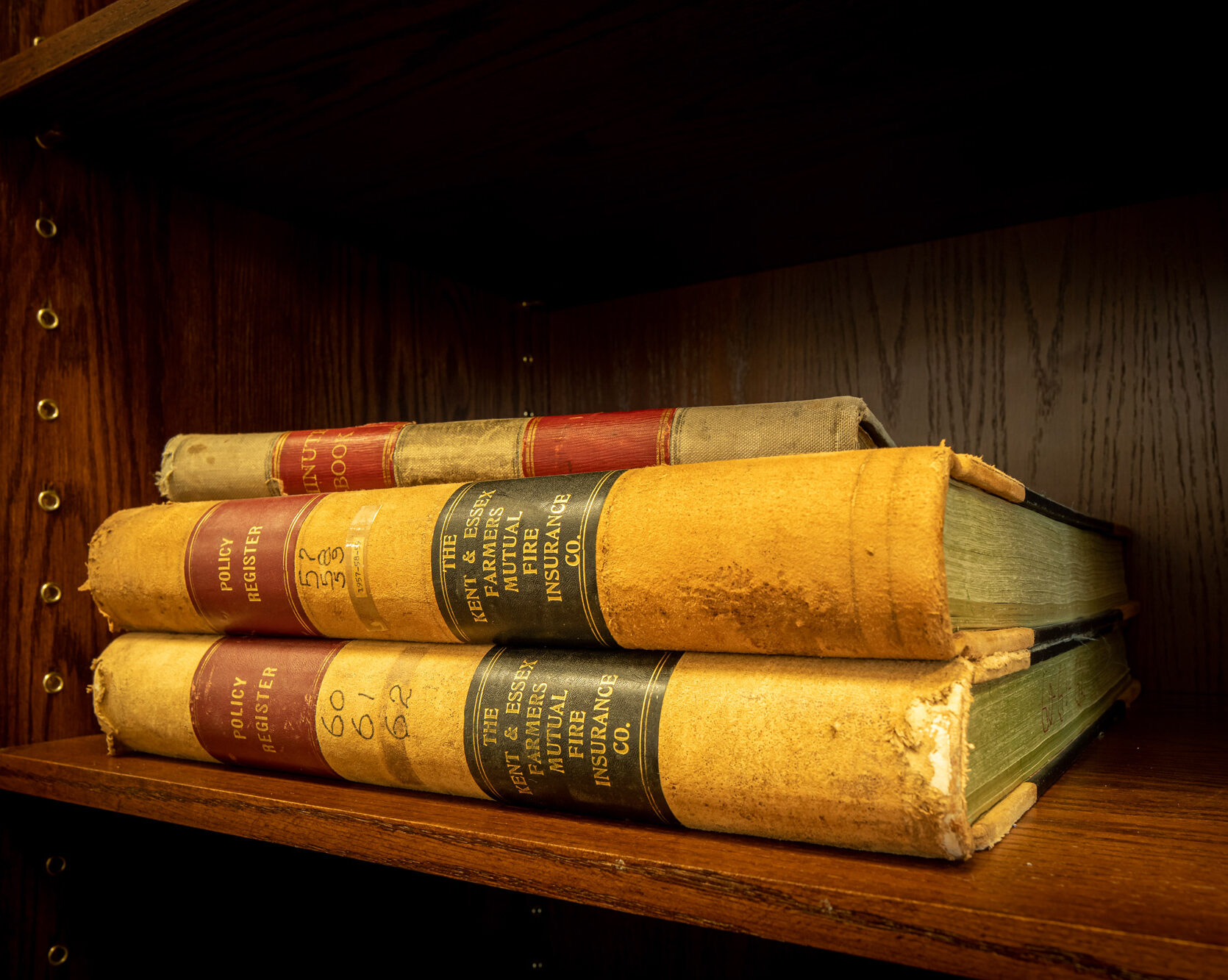

Kent & Essex is one of Ontario’s largest and longest-standing Mutual Insurance providers. Being a Mutual provider, we are owned entirely by our policyholders. That means when you hold an insurance policy with us, you are also a part-owner of the company! When the company is profitable, profits are distributed amongst our members via a refund of surplus.

We are a highly profitable enterprise delivering auto, home, farm, and commercial insurance through a network of independent brokers located across Southwestern Ontario. Premiums stay within our local communities, allowing us to support various charitable initiatives and organizations. We pride ourselves on maintaining these small-town values while providing policyholders with the highest-quality insurance products at competitive prices.

Our team of experts at Kent & Essex Mutual are familiar with unique insurance needs of the communities we serve. Our in-house adjusters will guide you through the claims process and we provide a 24 hour emergency claims service. We are truly here to serve YOU.

When looking to place auto insurance with K&E some of the information you will need available for your broker:

- Vehicle details including the year, make, model, value, and vehicle identification number (VIN)

- Vehicle usage (i.e.: pleasure, farm, business, or commercial), distance driven in kilometres (one-way) to work, and total kilometres driven annually

- All drivers’ details including gender, date of birth, marital status, years licensed for all levels (G1,G2 & G), driver’s training, and prior insurance information

- Drivers’ history – details regarding tickets/traffic infractions in the last three years, license suspensions, or accidents/claims in the last six years (date and type of loss will also be required in these scenarios)

- If you’re applying for insurance outside of your home province, an experience letter and driver’s abstract will be required

- Coverages and deductibles required for all vehicles

When looking to place property insurance with K&E some of the information you will need available for your broker:

- Any prior insurance information

- Property details – address, postal code, square footage, age of home, etc.

- Any home updates undertaken for roofing, heating, plumbing or wiring

- Any water or sewer backup prevention measures installed in your dwelling (including your home’s distance to any body of water)

- Coverages, deductibles, and liability limits required

- Alarm system information

- Unique details of your home (your broker will complete an evaluation on your home for accurate replacement value)

- Details of any property claims in the past five years (date of claim and cause of loss)

- Mortgage details with name and address of all Mortgages

- Any extra coverages required for jewellery, boats, fine art collections, etc.

- If your landlord requires you to have a tenant policy, less information will be required, but basic dwelling information is still necessary to complete your application

Here are some questions you should ask your broker when applying for insurance:

- What coverage options are available? I.e: Accident forgiveness, water protection, etc.

- What replacement cost coverage options are available?

- What liability limit do you recommend for my protection?

- Are there exclusions on my policy I should know about?

- What payment options are available?

- Is there a discount if I combine my auto and home insurance?